Changes to VAT on the day the UK leaves the EU – details of new White Paper

There has been significant confusion and differing views over how the UK would treat existing CJEU case law and its impact on the UK legislation when the UK leaves the EU.

Welcome certainty and clarity has been provided by the publication of a White Paper in respect The Great Repeal Bill (GRB). Full details of the GRB here

Background

The European Communities Act 1972 (ECA) gives effect in UK law to the EU treaties. It incorporates EU law into the UK domestic legal order and provides for the supremacy of EU law. It also requires UK courts to follow the rulings of the Court of Justice of the European Union (CJEU). Some EU law applies directly without the need for specific domestic implementing legislation, while other parts of EU law need to be implemented in the UK through domestic legislation. As explained in the White Paper, domestic legislation other than the ECA also gives effect to some of the UK’s obligations under EU law. The government states that “…it is important to repeal the ECA to ensure there is maximum clarity as to the law that applies in the UK, and to reflect the fact that following the UK’s exit from the EU it will be UK law, not EU law, that is supreme.” The GRB will repeal the ECA on the day we leave the EU.

Overview

The main point stressed in the White Paper is that “The same rules and laws will apply on the day after exit as on the day before. It will then be for democratically elected representatives in the UK to decide on any changes to that law, after full scrutiny and proper debate” and “This Bill will, wherever practical and appropriate, convert EU law into UK law from the day we leave so that we can make the right decisions in the national interest at a time that we choose.”

The intention is that the GRB will do three things:

- It will repeal the ECA and return power to UK institutions.

- The Bill will convert EU law as it stands at the moment of exit into UK law before we leave the EU. This allows businesses to continue operating knowing the rules have not changed significantly overnight, and provides fairness to individuals, whose rights and obligations will not be subject to sudden change. It also ensures that it will be up to the UK Parliament (and, where appropriate, the devolved legislatures) to amend, repeal or improve any piece of EU law (once it has been brought into UK law) at the appropriate time once we have left the EU.

- The Bill will create powers to make secondary legislation. This will enable corrections to be made to the laws that would otherwise no longer operate appropriately once we have left the EU, so that our legal system continues to function correctly outside the EU, and will also enable domestic law once we have left the EU to reflect the content of any withdrawal agreement under Article 50.

This means that case law precedent from the CJEU will continue to apply (for a time at least). Any uncertainties/disagreements over the meaning of UK law after the UK leaves the EC that has been derived from EU cases will be decided by reference to the CJEU case law as it exists on the day the UK leaves. As a consequence, the GRB is likely to give CJEU case law similar precedent status to the UK Supreme Court. The result is that Tribunals (and other court cases) will be heard in a similar way as they are now and both sides may continue to rely on case law as they have up to this point. Any changes to the VAT legislation, if any, may then be made at a more leisurely pace while providing certainty while this is done.

Customs

There will also be changes to the current UK Customs regime as a consequence of the UK leaving the Single Market. The Customs Declaration Services (CDS) programme is intended to replace the existing system for handling import and export freight (CHIEF) from January 2019. Now that the Government has made a decision to leave the EU customs union, there is concern that this project is in place on time. A letter from the Treasury Select Committee states that “even modest delays, there is potential for major disruption to trade and economic activity”.

There are still a lot of uncertainties which will not be dealt with until we know the terms of the UK leaving and we will try to report these as soon as we have any information. Please subscribe to our free monthly e-newsletter to keep up to date on this, and other VAT developments. Simply email us at marcus.ward@consultant.com

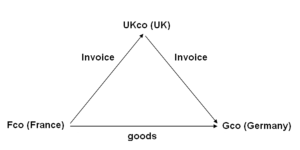

In this example; a UK company (UKco) receives an order from a customer in Germany (Gco). To fulfil the order the UK supplier orders goods from its supplier in France (Fco). The goods are delivered from France to Germany.

In this example; a UK company (UKco) receives an order from a customer in Germany (Gco). To fulfil the order the UK supplier orders goods from its supplier in France (Fco). The goods are delivered from France to Germany.